Guide to Car Tax 2023 to 2024

Published Date: 28th Mar 2023

In the UK, Vehicle Excise Duty (VED) or road tax is a mandatory annual charge that every vehicle owner must pay to use public roads. The rate for VED is determined by various factors, such as the vehicle's carbon dioxide emissions, fuel type, and the car's original purchase price. VED is split into two main rates: the first-year and annual rates.

In the UK, Vehicle Excise Duty (VED) or road tax is a mandatory annual charge that every vehicle owner must pay to use public roads. The rate for VED is determined by various factors, such as the vehicle's carbon dioxide emissions, fuel type, and the car's original purchase price. VED is split into two main rates: the first-year and annual rates.

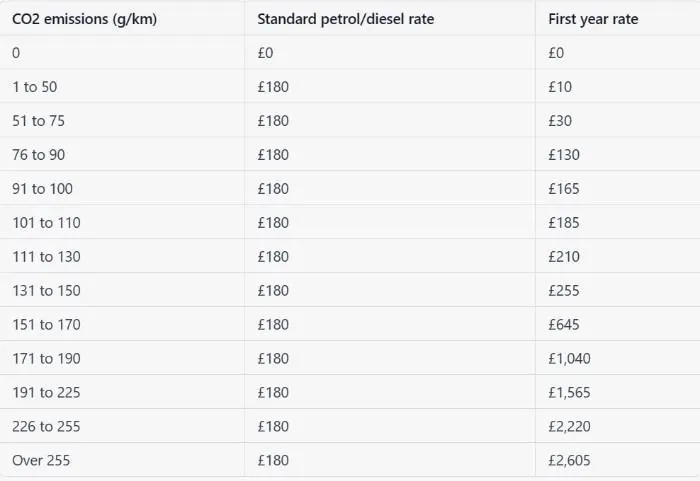

The first-year rate is based on the vehicle's CO2 emissions and ranges from £0 for zero-emission cars to £2,605 for models that emit 255g/km or more. Meanwhile, the annual rate for the 2023/2024 financial year is £180, an increase from the previous year's rate of £165, with a £10 discount for alternative fuel vehicles. However, cars that cost £40,000 or more after options are subject to a £390 annual supplement that runs for five years. This additional cost applies from the second to the sixth year of the car's life, with the first-year CO2-based charge excluded.

The current 2023/2024 VED First Year rates are as follows:

- Cars that cost £40,000 or more are subject to an additional £390 per year supplement for five years.

- Electric cars are exempt from VED for the first five years of registration.

- VED can be paid annually or in six-monthly instalments.

- To pay VED, you will need to provide your vehicle's registration number and the date on which it was first registered. You can pay VED online, by phone, or by post.

UK NEW 24 PLATE CAR DEALS DISCOUNT OFFERS PRICING

Owners of hybrid cars, mild hybrids, and plug-in hybrids pay £170 annually, while electric cars are exempt from first-year and annual road tax. From April 2025, electric vehicles will no longer have VED exemption, and owners will pay £10 per year as the first-year rate. If you're buying a new car, the VED rate will be based on the current tax band system introduced on 1 April 2017 and most recently adjusted for April 2023 onwards. On the other hand, if you're purchasing a used car registered before April 2017, the rate you'll pay will be based on the old VED system applicable at the time of first registration. You can opt to pay your VED annually or by monthly direct debit, with the latter incurring more due to interest.

If you're buying a car with CO2 emissions over 255g/km, you'll pay a whopping £2,605 for the first-year VED tax rate. However, if you're buying an electric car, you won't have to pay anything for the first year. From April 2025, the VED exemption for electric cars will be removed, and owners will pay a first-year rate of £10.

After the first year, the VED rate is based on the car's list price and its fuel type. For the 2023/2024 tax year, the current annual flat rate of road tax is £180, which is up from £165 in the previous financial year. Alternative fuel vehicles (AFVs), including hybrids, mild hybrids, and plug-in hybrids, are eligible for a £10 discount, meaning their owners pay £170 per year.

If the car you're buying costs over £40,000 (based on RRP, not price paid), you'll have to pay an additional annual supplement of £390, which runs for five years, after the first year's CO2-based charge. This means you'll pay £570 a year (£560 for hybrids) for five years if your car is valued at over £40,000. After that, the annual road tax reverts back to the standard rate of £180 per year (£170 for AFVs).

Fully electric cars are the only exception to this rule, as they are exempt from both the first-year and annual road tax charges and the supplement for cars costing over £40,000. It's worth noting that if you haggle a car costing over £40,000 down to below this threshold, you'll still have to pay the supplement as it's based on the cost of the car for tax purposes.

Finally, it's worth noting that you can pay your car tax by monthly direct debit instead of annually. This is a useful option for those wanting to spread their payments and prevent forgetting to pay their road tax. However, it will cost slightly more due to interest. The DVLA should automatically cancel the direct debit if you sell the car or it's written off, but it's worth double-checking this eventuality should it occur.

Finally, it's worth noting that you can pay your car tax by monthly direct debit instead of annually. This is a useful option for those wanting to spread their payments and prevent forgetting to pay their road tax. However, it will cost slightly more due to interest. The DVLA should automatically cancel the direct debit if you sell the car or it's written off, but it's worth double-checking this eventuality should it occur.

Vehicle Excise Duty (VED), also known as road tax, car tax, or the road fund licence, is a tax that must be paid on all vehicles registered in the UK. The amount of VED payable is determined by a number of factors, including the vehicle's emissions and its value.

Paying your car tax is a simple process that can be done online or at a Post Office. To tax your car online, simply visit the Gov.uk website and select the 'Tax your vehicle' page. You'll need a reference number from a V11 reminder letter that you've received from the DVLA, and then you can follow the step-by-step process to complete your payment. Alternatively, you can visit a Post Office and pay your car tax in person, taking your V5C with you. If you prefer, you can also use the DVLA's 24-hour vehicle tax service by calling 0300 123 4321.

- Vehicle Excise Duty (VED), or road tax, is a mandatory annual charge for every vehicle owner to use public roads in the UK.

- VED is split into two rates: the first-year rate and the annual rate, and it is determined by various factors such as carbon dioxide emissions, fuel type, and original purchase price.

- The first-year rate ranges from £0 to £2,605 depending on the CO2 emissions of the vehicle, while the annual rate for the 2023/2024 financial year is £180, with a £10 discount for alternative fuel vehicles.

- Cars costing £40,000 or more are subject to an additional annual supplement of £390 for five years, starting from the second year, except for fully electric cars, which are exempt from this rule.

- Hybrid cars, mild hybrids, and plug-in hybrids pay an annual road tax of £170, while electric cars are exempt from both first-year and annual road tax charges.

- From April 2025, electric vehicles will no longer be exempt from VED and will pay a first-year rate of £10.

- The VED rate for a new car is based on the current tax band system, while for a used car registered before April 2017, the rate is based on the old VED system.

- Car owners can choose to pay their VED annually or by monthly direct debit, with the latter option incurring more due to interest.

UK NEW 24 PLATE CAR DEALS DISCOUNT OFFERS PRICING

**Note that whilst this article's information was correct at the time of writing, please check with the DVLA & .Gov websites to confirm the tax figure at the point you tax your vehicle.